Does Acquiring New Customers with Direct Mail Make Sense for You?

While many companies are open to using direct mail in their multi-channel marketing campaigns, they still have questions. In a recent webinar, Kevin Naughton, President of PrintComm interviewed direct mail and data expert, Frank Martin, to get his take on the effectiveness of using direct mail as a prospecting tool.

Q: Is Direct Mail an Effective Prospecting Tool?

Frank: Direct mail can be a very effective prospecting tool. Targeted direct mail can be a very effective prospecting tool that allows you to zero in on just prospects. Alternate shared mail methods like Val-Pak and Red Plum carpet bomb everyone, including your current customers. Prospects should be given compelling offers to inspire them to visit your store or purchase your product/service.

Mass delivery options typically target all recipients with the same offers. When those offers are extended to customers, the impact on margin can be significant. Targeted pieces will give you a better chance of flying under your competitors’ radar.

Targeted direct mail employs relevance and tells a compelling story. It’s highly measurable and scalable.

Q: Some Think Direct Mail is Expensive. Is Direct Mail Really Expensive?

Frank: I think there’s a tendency to look at the total spend and the number of people being reached and say, “Holy cow—I’m only getting this many people for this much money?” That’s why marketers need to focus on acquisition cost versus outbound cost per thousand.

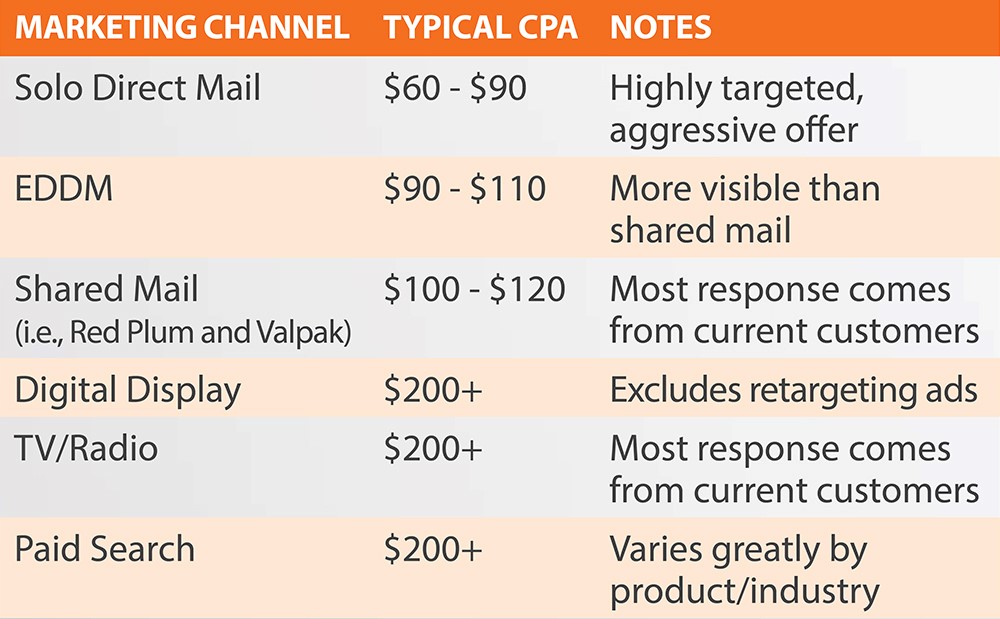

Cost per acquisition (CPA) is computed by dividing campaign spend by new customers acquired. Campaign spend should include all creative, printing and postage, or click and display costs, and promotion costs. Targeted direct mail stacks up favorably to other channels in CPA. The CPA for targeted DM is frequently less than $70–while marriage mail can typically cost more than $125 per new customer and digital costs commonly exceed $250 per customer.

To see more CPA’s on various marketing channels—check out our featured image above.

Q: What Are the Keys to Effective Direct Mail Prospecting?

Frank: In years past, the commonly accepted success equation was 1/3 the list, 1/3 creative, and 1/3 the offer. However, that thinking has changed. The new success equation involves four key factors: 30% data, 30% offer, 30% timing and 10% creative.

Q: What Makes a Good Prospecting List?

Frank: The first criteria to a good prospecting list is the prospect must be qualified to buy. In the B2C world, the prospect needs to live near the store. They must meet basic demographic requirements, which will vary based on the product or service being sold. They must be able to afford your product or service. And, they should represent a high-value buyer. In other words, they should fall into the big spender segment.

Prospects who showed a propensity to respond to other direct mail should be selected, if at all possible. Most compiled list providers have a mail responsiveness indicator. Magazine subscriber lists and donor lists also present strong possibilities.

In the retail space, co-op lists can be powerful. Co-op lists are compiled from data contributed by retailers. That comes with a catch. To receive data, you must contribute data. Most co-op list purveyors won’t sell another retailer’s data straight up. They will require that data be contributed by 10 or more retailers to sell specific segment data.

Emphasize quality over quantity. Don’t buy names just to pump up your quantity. If you have more budget than names, increase frequency before buying lesser quality names.

Q: What Makes a Good Offer and Message?

Frank: In a nutshell, it needs to be compelling and simple. Serious contemplation should be given to what will motivate the buyer to break their current buying pattern or behavior. It is simple–ask yourself, “Would this offer cause me to act?” Exclusivity and urgency can also produce positive results. If the offer isn’t compelling, people won’t act.

Marketers in the B2C space are sometimes tempted to offer “FREE” stuff. Martin maintains that it’s better to have a really good deal rather than giving stuff away so you don’t attract freeloaders. Conduct offer testing to help determine which offers draw a crowd of people that will turn into ongoing, high-value customers.

Messaging should focus on the benefits of switching to your product or service. The offer can be one of those benefits. That can be contrasted with the risk of staying put, which means they lose your benefits and lose your offer.

Messaging should also make it really easy for the prospect. Consider including guarantees, maps to your location, and dedicated service.

Q: How Do You Account for Timing?

Frank: If you can tie in with lifestyle triggers, that’s a real plus. Those might include events like moves, birth of children, a mortgage or finance contract ending, a warranty ending, or age-based triggers. Give serious thought to the events that occur in the prospects’ world that portend the need or want for your product.

Behavioral triggers should also be considered. These can include website downloads, requests for info, contest entries, and more.

Mailing frequency should be based on typical buying patterns and seasonality. A grocery or pet supply retailer would mail very frequently as the prospect needs these items very often. On the other hand, a lawn care provider would be best served to blitz the prospects at the start of the season.

About Frank Martin

Frank Martin has over 30 years of direct marketing experience. He spent 8 years as a research director for a compiled list company, 17 years as an owner of a direct marketing agency and over 5 years as a CRM director in the retail and travel industries. His passion has always been using data to create targeted and highly personalized marketing communications.

Want to Improve Your Direct Mail?

Request our FREE Direct Mail Assessment to discover potential improvement opportunities or contact us at 810-239-5763 or here.

Key Takeaways:

- Be Laser-Focused on Cost Per Acquisition (CPA)

- Put Most Effort into List, Offer, and Messaging (Instead of Creative)

- Quality Over Quantity